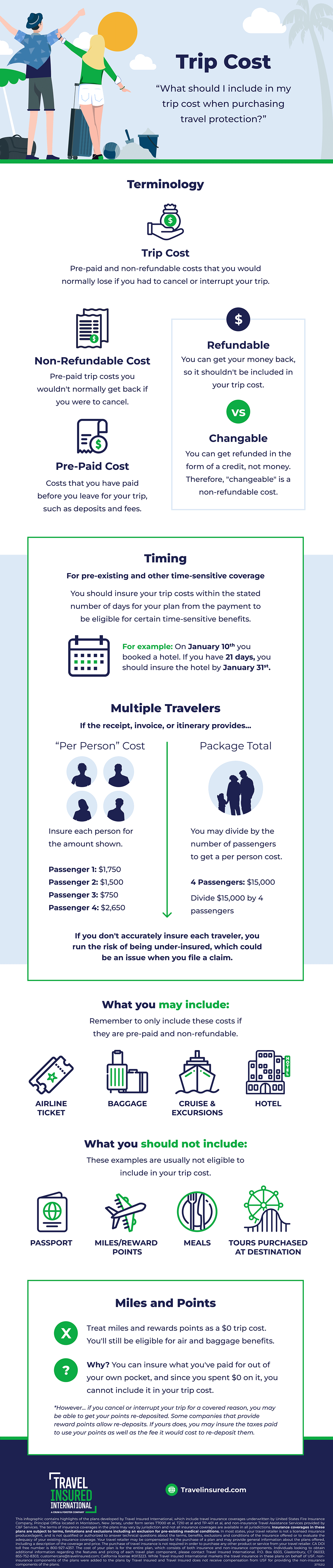

What should I include in my trip cost when purchasing travel protection?

TERMINOLOGY

- TRIP COST

Pre-paid and non-refundable costs that you would normally lose if you had to cancel or interrupt your trip.

- PRE-PAID COST

Costs that you have paid before you leave for your trip, such as deposits and fees.

- NON-REFUNDABLE COST

Pre-paid trip costs you wouldn't normally get back if you were to cancel.

- Refundable: You can get your money back, so it shouldn't be included in your trip cost.

- Changeable: You can get refunded in the form of a credit, not money. Therefore, "changeable" is a non-refundable cost.

TIMING FOR PRE-EXISTING AND OTHER TIME-SENSITIVE COVERAGE

You should insure your trip costs within the stated number of days for your plan from the payment to be eligible for certain time-sensitive benefits.

EXAMPLE

On January 10th you booked a hotel.

If you have 21 days, you should insure the hotel by January 31st.

MULTIPLE TRAVELERS

IF THE RECEIPT, INVOICE, OR ITINERARY PROVIDES...

- ...a per person cost

- Insure each person for the amount shown.

EXAMPLE

Passenger 1: $1,750

Passenger 2: $1,500

Passenger 3: $750

Passenger 4: $2,650

- ...a package total

- You may divide by the number of passengers to get a per person cost.

EXAMPLE

4 Passengers: $15,000

Divide $15,000 by 4 passengers

If you don't accurately insure each traveler, you run the risk of being under-insured, which could be an issue when you file a claim.

WHAT YOU MAY INCLUDE

Remember to only include these costs if they are pre-paid and non-refundable.

- AIRLINE TICKET

- BAGGAGE

- CRUISE & EXCURSIONS

- HOTEL

WHAT YOU SHOULD NOT INCLUDE

These examples are usually not eligible to include in your trip cost.

- PASSPORT

- MEALS

- MILES/REWARD POINTS

- TOURS PURCHASED AT DESTINATION

MILES AND POINTS

Treat miles and rewards points as a $0 trip cost. You'll still be eligible for air and baggage benefits.

WHY?

You can insure what you've paid for out of your own pocket, and since you spent $0 on it, you cannot include it in your trip cost.

HOWEVER...

If you cancel or interrupt your trip for a covered reason, you may be able to get your points re-deposited.

Some companies that provide reward points allow re-deposits. If yours does, you may insure the taxes paid to use your points as well as the fee it would cost to re-deposit them.