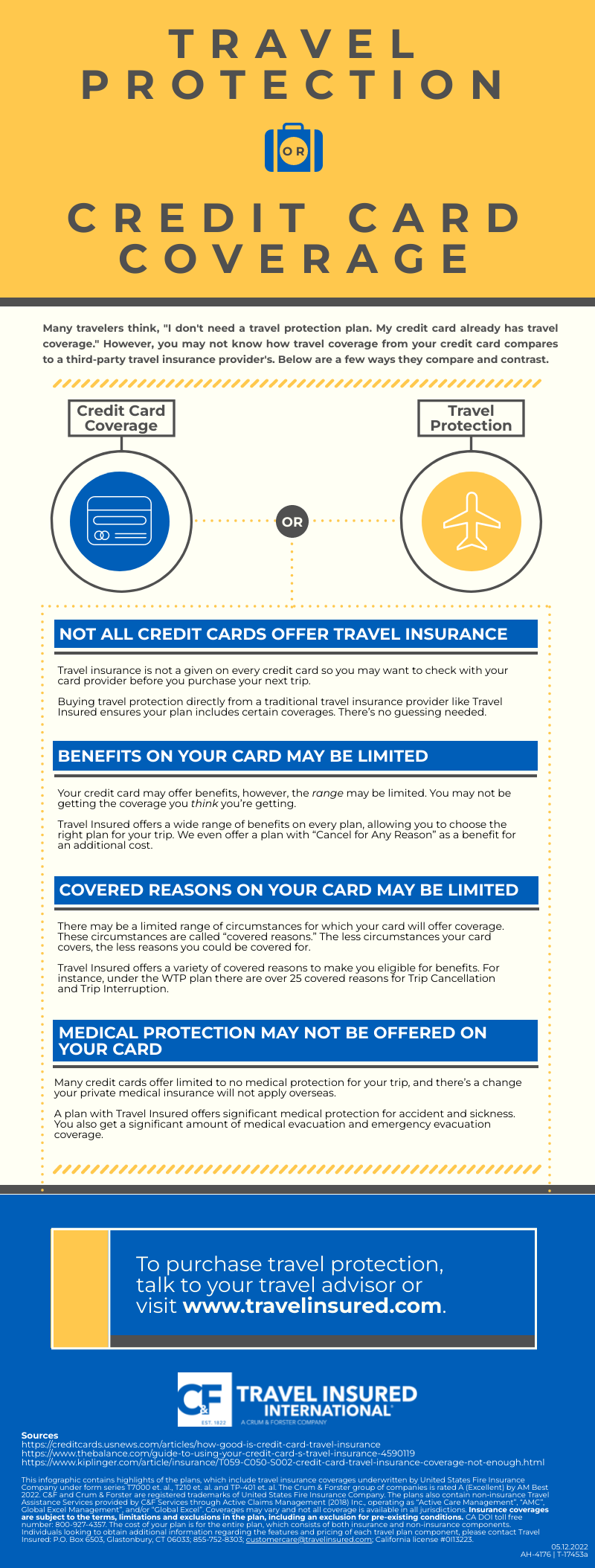

Travel Protection or Credit Card Coverage

Many travelers think, "I don't need a travel protection plan. My credit card already has travel coverage." However, you may not know how travel coverage from your credit card compares to a third-party travel insurance provider's. Below are a few ways they compare and contrast.

NOT ALL CREDIT CARDS OFFER TRAVEL INSURANCE

Travel insurance is not a given on every credit card so you may want to check with your card provider before you purchase your next trip. Buying travel protection directly from a traditional travel insurance provider like Travel Insured ensures your plan includes certain coverages. There's no guessing needed.

BENEFITS ON YOUR CARD MAY BE LIMITED

Your credit card may offer benefits, however, the range may be limited. You may not be getting the coverage you think you're getting. Travel Insured offers a wide range of benefits on every plan, allowing you to choose the right plan for your trip. We even offer a plan with "Cancel for Any Reason" as a benefit for an additional cost.

COVERED REASONS ON YOUR CARD MAY BE LIMITED

There may be a limited range of circumstances for which your card will offer coverage. These circumstances are called "covered reasons." The less circumstances your card covers, the less reasons you could be covered for. Travel insured offers a variety of covered reasons to make you eligible for benefits. For instance, under the WTP plan there are over 25 covered reasons for Trip Cancellation and Trip interruption.

MEDICAL PROTECTION MAY NOT BE OFFERED ON YOUR CARD

Many credit cards offer limited to no medical protection for your trip, and there's a change your private medical insurance will not apply overseas. A plan with Travel Insured offers significant medical protection for accident and sickness. You also get a significant amount of medical evacuation and emergency evacuation coverage.