Traveling with a group can be an unforgettable experience, but managing expenses can quickly become complicated. From accommodations and transportation to meals and excursions, ensuring that everyone pays their fair share can be essential to maintaining harmony and avoiding financial disputes.

Proper cost allocation is important not only for fairness but also for practical reasons such as budgeting, record-keeping, and even insurance coverage. Whether traveling with friends, family, or colleagues, using the accurate methods for splitting travel costs can help make the entire experience smoother and more enjoyable.

So, let’s look at a few ways to help manage your group travel expenses effectively while making sure every traveler is properly covered.

Understanding Per Person vs. Package Total Costs

When planning group travel, one of the first decisions you’ll likely need to make is how to define and split costs.

There are two primary ways to calculate expenses: “per person” and “package total.”

"Per person" costs are expenses that can be directly assigned to each traveler. These costs are typically straightforward and easy to split, such as:

- Individual airfare

- Meals paid separately

- Tickets for events or attractions purchased per person

- Travel protection costs (when purchased individually)

Package Total costs apply when a group purchases bundled travel services, such as vacation packages, accommodations, or group tours. These costs must then be divided among all travelers. Examples include:

- Hotel room costs split among roommates

- Group tour fees with a single invoice

- Car rentals or shared transportation

- Airbnb or vacation rental bookings

When to Use Each Approach

- Use per person costs when each traveler is responsible for their own bookings and purchases.

- Use package total costs when a single person pays for a group service and reimbursement is needed.

Understanding these differences will help you decide the best way to manage your group costs, understand how expenses will be divided among the group, and help you tremendously in the event that you need to make a claim later on.

Methods for Splitting Travel Costs

There are several ways to fairly divide expenses among travelers. There is no “right” way, it just depends on the group's preferences and the type of expenses incurred.

Why Accurate Per-Person Costs Matter for Travel Protection

Accurate cost allocation is an important part of purchasing any travel protection plan in case you encounter the unexpected and need to make a claim. Here’s why:

- Travel protection often reimburses expenses based on individual trip costs.

- If costs are inaccurately reported, coverage may not fully apply to each insured traveler.

Whether the airline lost your luggage, you need to cancel at the last moment due to an emergency, or any other set of unexpected circumstances that turn your travel plans upside-down, you don’t want to wind up paying out of pocket for things your travel protection plan covers because you didn’t keep track of or insure your travel costs.

Detailed expense records can help to expedite the claims process, while misreported expenses could lead to denied claims or delayed reimbursements—neither one a scenario you or your group want to find yourself in.

To ensure that doesn’t happen, here is a handy list of best practices to help you manage your group travel expenses.

Documentation (As In, Keep It!)

- Keep invoices, receipts, and booking confirmations for all expenses.

- Clearly document who paid for what, especially if reimbursements were made.

Whether you keep your documentation in a folder in your email account or in an envelope under your pillow, compiling this information is essential for filing accurate travel protection claims and you don’t want to be left without it.

Pre-Trip Planning and Budgeting

- Discuss budget expectations with your group before booking.

- Assign responsibility for major purchases (e.g., one person books accommodations, another books transportation).

- Establish a shared digital expense tracker.

Keeping Detailed Records

- Save digital copies of all receipts.

- Track who paid for what and when reimbursements were made.

- Use banking apps or travel expense tools to streamline tracking.

Managing Shared Expenses

- Set a spending limit on shared costs to ensure fairness.

- Use a shared bank account or travel fund for group purchases.

- Avoid one person fronting all costs to prevent financial strain.

Setting Clear Expectations

- Determine how costs will be split before departure.

- Communicate how reimbursements should be handled.

- Ensure everyone agrees on trip expenses to avoid conflicts later.

Digital Solutions for Cost Splitting

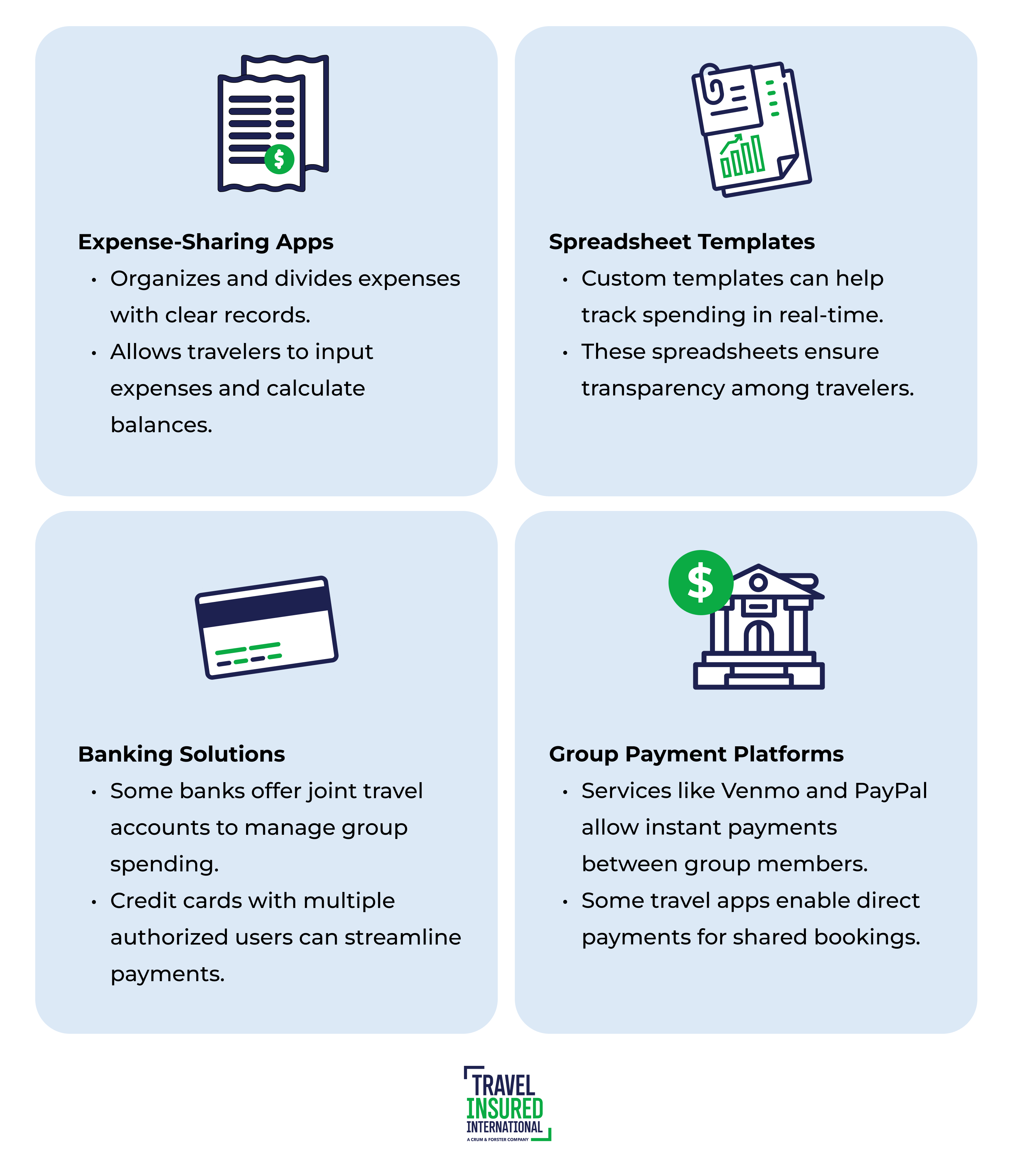

From expense-sharing apps to group payment platforms, there are numerous tools available to simplify cost-sharing and help make managing your group finances easier and more transparent while traveling:

Wrapping It Up

Learning how to effectively split your group travel costs fairly (and accurately) is important to help you create a smooth and enjoyable travel experience and assist you if something unexpected happens.

Already planning a group adventure and want to protect your investment? Share a few basic details of your travel itinerary and receive a quote immediately.